Many of my friends and employees at Cobalt have asked me what fundraising is like and what the first steps are to start a company. I’ve written this post to help demystify some of the process based on my experience raising 5 rounds over my career (Seed through Series C with Cobalt Robotics and Seed for Posmetrics (YC W13)). I hope many more people will start their own companies in the future and work at places that encourage entrepreneurship. Enjoy!

Fig 1. Silicon Valley Formal Attire is still a mystery

Fig 1. Silicon Valley Formal Attire is still a mystery

What Investors Want to See

A Big Plan

Investors make most of their money from their best 1-2 investments in their entire career. Convince investors that you are going to be one of those few best investments they’ll ever make. That requires a few things at minimum:

- Unfair Advantage - also sometimes known as “Founder Market Fit”. Why should they bet on you winning this market when several startups will probably have exactly the same idea? Why are you going to be passionate enough about this to work on it for 10 years?

- Defensive Moat. As you become successful and other people want to copy you there will be some reason why they cannot ever catch up. The classic examples of defensive moats are Network Effect, Brand Loyalty, and the contentious Data Moat. “We’ll work harder and smarter than them” is not a moat.

- Market size is at least $1B. If it’s not, you need to find a convincing path to reach $1B ARR from your initial market - i.e. selling books online is just your first market; soon you’ll sell everything online.

When we were raising our seed round at Cobalt Robotics in 2016 from Bloomberg Beta we nailed all 3 of these. For founder-market fit, both Travis and I had long histories in robotics, and we had a core advisor deep inside the security industry. Our moat was the high barrier to entry for hardware startups, and the high switching cost for our customers once we become fully integrated into their security programs. Our ultimate market was huge - $32B is spent per year on security - and our initial beachhead market of indoor, single-floor buildings was big enough to start.

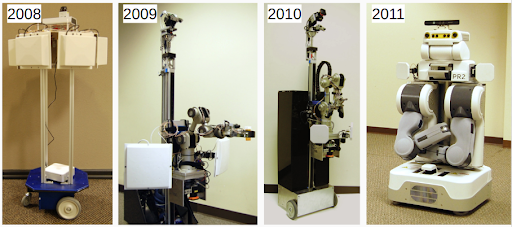

Fig 2. Part of our Seed Pitch Deck showing Travis’s long history in the robotics space to demonstrate founder-market fit.

Fig 2. Part of our Seed Pitch Deck showing Travis’s long history in the robotics space to demonstrate founder-market fit.

Charisma

The unofficial 4th item on this list is Charisma. It can be easy to dismiss the kind of charisma that Steve Jobs, Adam Neuman, or Elizabeth Holms had as “cheating” the system, but being incredibly persuasive is actually a superpower that most startups need in order to succeed. Investors aren’t “fooled” by charisma - they’re identifying an actual skill that will be critical for hiring, sales, and future fundraising. To succeed you need real substance behind you, but you also need to be able to sell the vision. Steve Wozniak could not have built Apple without Steve Jobs, and vice versa.

Luckily for us engineers, charisma is actually a skill that can be practiced and improved! The key is practice with feedback. Do as many low-stakes pitches as you can, to your friends, your family, anyone that will listen. While you pitch, have your co-founder or a friend take notes of the other person’s reactions and experiment with what phrasing and facts resonate with people and which don’t.

When pitching our seed round, we would write down any question or objection that came up and then alter the pitch the next time and include the counter argument before the question could even arise. The result was a confident and compelling pitch.

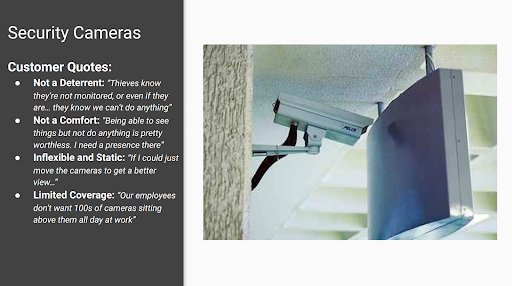

Fig 4. This became one of the first slides in our seed deck because “why robots, not just more cameras?” was such a common question.

Fig 4. This became one of the first slides in our seed deck because “why robots, not just more cameras?” was such a common question.

Fear of Missing Out

Beyond those concrete items, a lot of people talk about “FOMO”, Momentum, and Hype dominating venture investing. It’s easy to make fun of cases like WeWork, Theranos, and Clinkle, but these false positives actually make a lot of sense if you think about the incentives at work as a round closes! Investors care more about missing a potential unicorn than investing in something that flops. If they didn’t, they’d be too risk averse to bet on anything new and exciting! FOMO isn’t something that can be manufactured, it’s the end result of a well executed fundraise with a promising opportunity.

Fig 3. It can be very difficult to tell apart something dramatically new from dramatically wrong. I’d rather both get funding than neither.

Fig 3. It can be very difficult to tell apart something dramatically new from dramatically wrong. I’d rather both get funding than neither.

Momentum is important because it creates urgency to close the deal, a necessary ingredient for any sales process. Without urgency to close the deal, it’s in investors’ best interest to keep saying “This looks great, let’s chat again in a month when you have more progress!”.

Do all your pitching in a short compressed time, so you’re getting term sheets at the same time from different investors. It can be very scary to negotiate terms if you only have a single offer at a time and are unsure of whether you’ll be able to get more. Having them all synchronized gives you a real BATNA for those negotiations.

How Do You Actually Get In Touch With Investors?

Investors don’t have a “pitch here” button on their website. Investors would get large amounts of inbound interest, and so they use their network and social ties as a way to vet opportunities. It’s basically the same as hiring referrals - if the investor trusts me, and I trust you, the investor is more likely to trust you and listen to your pitch. Many people are critical of this model because of the exclusivity and “in-group” effect that it creates. That effect disadvantages women and people of color who don’t yet have access to these social networks.

To get in contact with an investor, find or create a mutual connection, especially a founder who that investor has backed. Most founders I know (including myself!) are open to cold outreach and love encouraging more people to start companies! Individual angel-investors (including myself!) are also more open to cold outreach than institutional investors.

For first time founders who don’t have that network, Y Combinator is a fantastic place to start. Unlike most investment firms, they directly take in cold applications from people anywhere in the world. When I was working on my first startup as a sophomore in college with no connections, we applied to YC and they were willing to take a bet on us! I’m very excited that more investors are creating similar ways for new people to come into the entrepreneurial ecosystem, like Sequoia’s Arc Program!

Who Should You Raise From?

When doing your initial outreach to investors, target those who have invested in companies similar to the one you want to build. If you’re trying to start a hardware startup, talk to investors who have backed other hardware startups.

It’s also much more important to find the right individual partner, rather than the right firm. While most name recognition is at the firm level (ie Sequoia, A16Z), each individual partner has very different focuses and skills.

Picking your lead investor is much more about fit than simply “highest offer wins”. You should think about which investor matches your working style most closely and will be able to add the most value - this is a new coworker that you cannot fire. What happens when you disagree? Will this investor be the first one you go to for advice? What will the investor bring to the table besides money? Ask them what the biggest help they’ve ever given to a portfolio company is.

Fig 5. (Hopefully) investors after your pitch

Fig 5. (Hopefully) investors after your pitch

Don’t just take their word for it - do reference checks! The investor will give you some introductions, but you should also find backdoor references in case they’re cherry-picking. Make sure to include a startup that has gone out of business to understand how the investor acts in the bad times as well as the good.

Stepping Stones

If you’re interested in starting your own company, but don’t think you’re ready, one of the best things you can do is to join an existing startup. You’ll see what life is like on the inside, especially at a startup that encourages entrepreneurial employees.

At Cobalt Robotics, we’ve hired many former founders, and also many of our employees have gone on to start their own companies with my enthusiastic support! If that sounds interesting, reach out and I’d love to be a resource to you, whether for fundraising or for a role at Cobalt to learn more about startups as a stepping stone along your journey.

Fig 6. A Cobalt Robot patrolling an office space. PS - We’re hiring!

Fig 6. A Cobalt Robot patrolling an office space. PS - We’re hiring!